Tech Insights: Apple vs. Competition

Explore the latest developments and comparisons between Apple and its rivals.

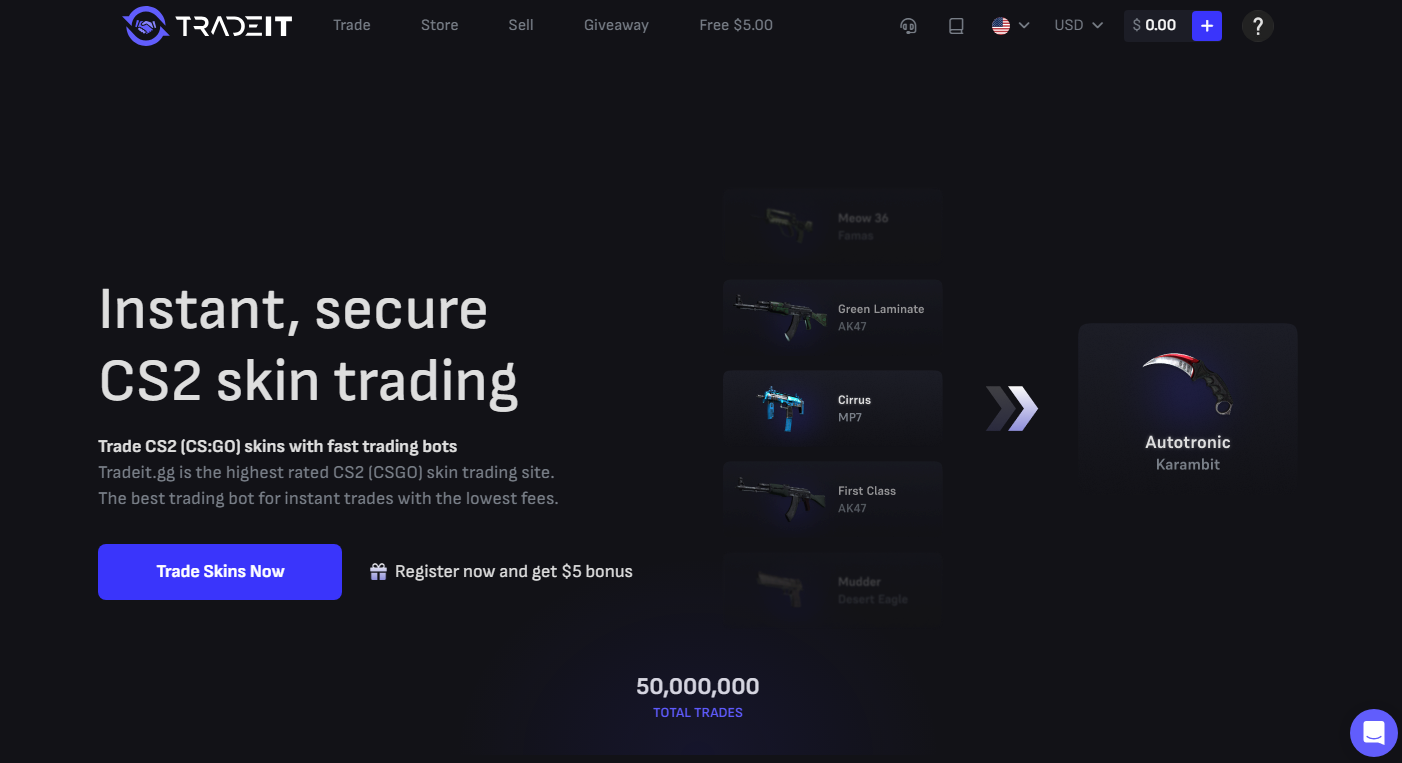

CS2 Trade Bots: The Silent Brokers of Your Digital Arsenal

Discover the secrets of CS2 Trade Bots—your ultimate allies in digital trading! Unlock profits with the silent brokers changing the game.

How Do CS2 Trade Bots Operate Behind the Scenes?

CS2 trade bots operate through a combination of algorithms and real-time data analysis, streamlining the trading process for users in the world of Counter-Strike 2. These bots utilize APIs to access the Steam market, where they can monitor prices and detect trading opportunities. By assessing supply and demand trends, the bots can execute trades automatically, allowing users to benefit from price fluctuations without having to constantly track the market themselves. This level of automation not only enhances efficiency but also minimizes the emotional biases that often affect trading decisions.

In addition to basic trading functionalities, more advanced CS2 trade bots incorporate machine learning techniques to improve their decision-making over time. They analyze historical trading data, identifying patterns and strategies that yield the best results. This involves backtesting their strategies against past performance to ensure profitability. Ultimately, users benefit from a sophisticated trading experience, as these bots adapt to evolving market conditions and optimize their trading tactics to enhance their overall profitability.

Counter-Strike is a popular tactical first-person shooter that emphasizes team-based gameplay and strategy. One of the unique weapons found in the game is the zeus x27, a powerful one-hit kill pistol that can surprise opponents in close quarters.

The Ultimate Guide to Maximizing Profits with CS2 Trade Bots

In the world of online trading, CS2 trade bots are increasingly becoming essential tools for maximizing profits. These automated systems can analyze market trends and execute trades much faster than human traders. To fully leverage the potential of CS2 trade bots, it’s crucial to understand their functionalities, strategies, and the types of algorithms that work best for your trading goals. You can start by setting clear objectives, defining your risk tolerance, and selecting a bot that aligns with your trading style.

Moreover, optimizing your CS2 trade bot settings can significantly enhance your profitability. Begin by fine-tuning parameters such as trading volume, stop-loss limits, and take-profit targets to match market conditions. Regularly backtest your strategies using historical data to measure performance and adjust your approach accordingly. Remember, consistent monitoring and iterative adjustments are key factors in ensuring long-term success with trade bots. By employing these techniques, you make your trading experience not only profitable but also sustainable.

Are CS2 Trade Bots the Future of Digital Trading?

The emergence of CS2 trade bots marks a significant shift in the realm of digital trading. These automated systems are designed to analyze market trends, execute trades, and manage investments with speed and precision that surpasses human capability. As technology continues to evolve, traders are increasingly turning to these bots to maximize their returns and minimize errors. The integration of artificial intelligence and machine learning in CS2 trade bots enhances their decision-making processes, allowing them to adapt to market fluctuations in real time, which is a game-changer for both novice and seasoned traders.

Moreover, the future of digital trading increasingly leans towards automation, making CS2 trade bots not just a trend, but a necessity for competitive trading strategies. As more individuals seek to enter the digital trading space, the accessibility of these bots simplifies the process, providing an opportunity for anyone to participate. In an industry marked by volatility, the reliability and efficiency of CS2 trade bots could redefine investment strategies, shaping the future landscape of trading where human intuition and experience augment automated systems rather than replace them.